Your Insurance Premiums Doubled Because Climate Change Is Repricing Risk

Climate-related supply chain disruptions cost businesses US$120 billion annually. Global insured losses from natural catastrophes reached $108 billion in 2024. Weather-related insurance losses have increased 250% over the past 30 years, adjusted for inflation.

Your insurance broker calls it “market conditions.” Your CFO sees it in the P&L. Your operations team deals with the disruptions. Climate change shows up as business risk across every function: higher costs, unreliable suppliers, regulatory complexity, talent challenges, and brand exposure.

Business leaders already manage crisis and adapt to disruption. What many don’t see is how climate change multiplies every business risk they already handle. The supply chain breaks you navigated during the pandemic? Climate makes those permanent. The insurance costs you absorbed? Climate makes them structural. The regulatory changes you adapted to? Climate accelerates them beyond your planning cycles.

Do you want to help? Read on.

Contents

How climate change impacts every business function

Climate change drives insurance costs up without warning

You’ve watched your company’s insurance costs climb. Property insurance doubled in three years. Business interruption coverage now costs more than your actual claims history would justify. Your broker explains it’s “market conditions” and “increased risk exposure.”

You know something changed, but the explanation feels vague.

Global insured losses from natural catastrophes topped $100 billion in 2023, up from $76 billion in 2020. Munich Re reported that weather-related insurance losses have increased 250% over the past 30 years, adjusted for inflation.

Your insurance company isn’t gouging you. They’re pricing in climate risk that shows up in their actuarial tables as undeniable mathematical reality. Coastal properties face insurance premium increases of 300–500% as carriers exit high-risk markets.

A manufacturing executive in Florida watched her facility’s flood insurance jump from $85,000 to $340,000 in two years. Her building hasn’t flooded. Her claims history is clean. But sea level rise in Miami has accelerated to 10 mm per year, and insurers know what’s coming even if individual buildings haven’t flooded yet.

You face the same calculation every business leader faces: absorb the cost, relocate operations, or hope the trend reverses. The trend won’t reverse. Global mean sea level has risen about 8-9 inches since 1880, with about a third of that coming in just the last 25 years.

Climate change talent crisis: Why employees leave companies without climate action

You’ve lost good people to competitors. Exit interviews reveal patterns. Younger employees want to work for companies that align with their values. They ask about sustainability initiatives in the interview. They check your ESG reports before accepting offers.

You thought this was millennial idealism. You’re realizing it’s a talent retention crisis.

83% of millennials and Gen Z employees say they’d leave their current job for one with a stronger commitment to climate action. Deloitte’s 2024 Gen Z and Millennial Survey found that climate change ranks as the number one societal concern for both generations.

Your competitor recently hired your best product manager. You matched the salary. You offered better equity. She took the other job anyway because they have a net-zero commitment and you have a sustainability page on your website that hasn’t been updated since 2019.

Companies with strong climate commitments see 24% lower employee turnover. That’s not correlation. That’s cause and effect showing up in your retention metrics whether you acknowledge it or not.

A tech CEO in Seattle lost three senior engineers to a competitor in a six-month period. All three mentioned climate policy in their exit conversations. The CEO spent $200,000 recruiting replacements. She could have spent $50,000 on an actual climate strategy and kept the talent she had.

Climate regulations and compliance: Navigating the new business landscape

You’ve navigated regulatory changes before. New safety standards. Updated accounting rules. Privacy regulations that required system overhauls. You budgeted for it. You hired consultants. You adapted.

Climate regulations feel different because they’re coming from every direction simultaneously, and they’re accelerating.

| Regulation | Jurisdiction | Who it affects | Compliance deadline | What’s required |

|---|---|---|---|---|

| EU CBAM | European Union | Companies exporting steel, aluminum, cement, fertilizers, electricity to EU | Phased: 2026–2034 | Emissions reporting for imported goods, carbon pricing |

| California Disclosure | California, USA | Companies with $1B+ revenue doing business in CA | 2026 (Scope 1&2), 2027 (Scope 3) | Annual emissions disclosure, climate risk reporting |

| SEC Rules | United States | All publicly traded companies | Pending final rule | Material climate risk disclosure, Scope 1&2 emissions |

| UK SDR | United Kingdom | Asset managers, financial services | 2024–2025 | Product-level sustainability disclosures |

| CSRD | European Union | Large EU companies, listed SMEs | Phased: 2025–2028 | Double materiality reporting, third-party assurance |

The EU’s Carbon Border Adjustment Mechanism affects any company exporting steel, aluminum, cement, fertilizers, or electricity to European markets. California’s climate disclosure requirements mandate emissions reporting for companies doing business in the state, even if they’re headquartered elsewhere. The SEC’s proposed climate disclosure rules would require publicly traded companies to report climate risks and emissions data.

You’re facing a compliance landscape where the rules change faster than you can implement them, where different jurisdictions have conflicting requirements, and where the penalties for non-compliance are material.

A pharmaceutical company spent $2 million building a carbon reporting system to comply with California requirements, only to discover six months later that the EU rules require different methodology and different data granularity. They’re rebuilding the system. They could have built it right the first time if leadership had treated climate compliance as infrastructure, not as a one-time project.

S&P Global reports that climate-related regulatory risk is now the top concern for CFOs globally, outranking traditional financial risks.

Climate-driven supply chain disruptions and adaptation strategies

You’ve dealt with supplier failures. A factory fire. A bankruptcy. A quality control breakdown. You had contingency plans. You activated backup suppliers. You managed through it.

Climate disruptions are different because they hit multiple suppliers simultaneously, they affect entire regions, and they don’t resolve on predictable timelines.

The 2021 Texas freeze shut down 40% of U.S. chemical production capacity, affecting supply chains for plastics, pharmaceuticals, electronics, and automotive manufacturing nationwide. The 2022 European drought reduced Rhine River water levels so dramatically that barge transport became impossible, stranding cargo and shutting down factories that relied on water-based transportation.

These weren’t isolated incidents. McKinsey estimates that climate-related supply chain disruptions will cost businesses $1.2 trillion annually by 2030.

An automotive parts manufacturer in Michigan sources components from 15 suppliers across three continents. In 2023, flooding in Thailand shut down one supplier for three months. Drought in Taiwan affected another. Heat waves in Phoenix disrupted a third. The company lost $8 million in revenue because they couldn’t complete assemblies without all components. They’re now mapping every supplier’s climate exposure and building redundancy, which will cost $3 million upfront but will save them from future disruptions they know are coming.

Climate risks translate directly to business costs

Before diving into solutions, here’s how climate impacts show up in your financial statements:

| Climate risk | Business impact | Quantified cost | Timeline |

|---|---|---|---|

| Extreme weather events | Supply chain disruptions, facility damage, lost production | $120 billion annually | Immediate and recurring |

| Insurance premium increases | Higher operating costs, reduced margins | 300–500% increases | 2–5 years |

| Regulatory compliance | New reporting systems, operational changes, potential penalties | $2–5 million per system | 1–3 years |

| Talent retention challenges | Recruitment costs, lost productivity, knowledge gaps | 24% higher turnover | Ongoing |

| Brand reputation damage | Lost customers, reduced market share, lower valuations | 45% of consumers stopped buying | 6–24 months after incident |

| Physical asset devaluation | Stranded assets, forced relocations | 10–20% decline | 5–15 years |

Climate accountability and brand reputation in the age of transparency

You’ve managed brand crises. A product recall. A customer service failure that went viral. An executive’s poorly worded statement. You deployed crisis communications. You apologized. You fixed the underlying issue. The story eventually died down.

Climate-related brand damage works differently because stakeholders now have tools to verify your claims, because greenwashing accusations spread faster than corrections, and because younger consumers have zero tolerance for companies that say one thing and do another.

A study by Kantar found that 67% of consumers expect brands to take a stand on climate, and 45% say they’ve stopped buying from brands whose climate actions don’t match their claims.

Your marketing team launches a sustainability campaign. Your PR team writes press releases about carbon commitments. Meanwhile, Climate Action 100+ publishes data showing your company’s emissions increased 12% in the recent reporting year. Employees leak internal documents showing leadership rejected proposals to actually reduce emissions. The campaign becomes a case study in greenwashing. Your brand reputation, built over decades, takes damage you’ll spend years repairing.

Unilever’s research found that sustainable brands grow 69% faster than traditional brands, but only if the sustainability commitments are real and measurable. Performance without substance gets punished harder than doing nothing at all.

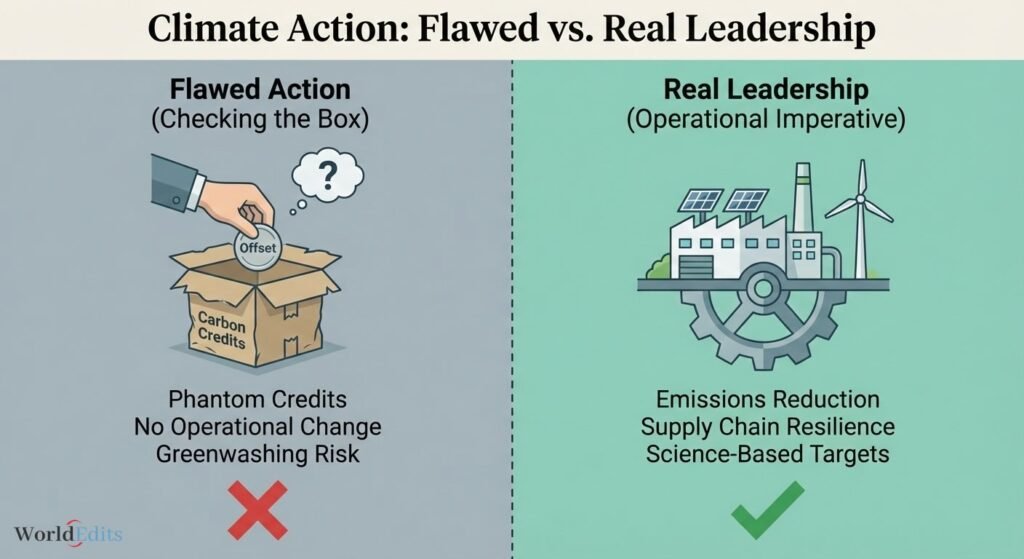

Why carbon offsets and ESG reports fail climate action goals

You’ve seen the presentations. Your sustainability team proposes carbon offset programs. You write checks to tree-planting organizations. You buy renewable energy credits. Your annual report announces carbon neutrality.

You know what that feels like. It feels like checking a box. It feels like doing something without changing anything.

Real climate action requires leaders to examine their actual operations, make hard decisions about how their companies function, and accept short-term costs for long-term survival.

A food manufacturer announced carbon neutrality by purchasing offsets. They didn’t change their packaging. They didn’t modify their supply chain. They didn’t reduce emissions from their facilities. Two years later, an investigation revealed that 60% of their purchased offsets came from projects that would have happened anyway, meaning they paid for carbon reduction that didn’t actually reduce carbon.

Research published in Science found that more than 90% of rainforest carbon offsets are likely “phantom credits” that don’t represent real emissions reductions. Additional studies show that corporate carbon neutrality claims are often based on low-quality offsets that overstate actual climate benefits.

That doesn’t mean offsets have no role. It means they can’t substitute for actual emissions reduction.

A software company reduced their office energy consumption by 40% through efficiency upgrades, switched their data centers to renewable power sources, and redesigned their product to require less computational resources. Then they bought offsets for their remaining emissions. That’s climate action. The offsets were supplemental to real operational changes, not a substitute for doing nothing.

The difference is leadership that treats climate as an operational imperative, not as a public relations problem.

Business climate action strategies leaders can implement today

You don’t need to wait for industry consensus or government mandates. You don’t need a chief sustainability officer or a carbon accounting platform. You need to use the decision-making authority you already have to make choices that reduce climate risk and demonstrate climate leadership.

Here’s what different climate actions cost and deliver:

| Action | Upfront investment | Payback period | Annual savings/benefits | Difficulty level |

|---|---|---|---|---|

| Energy efficiency upgrades (LED lighting, HVAC) | $50,000–$500,000 | 18–36 months | 20–40% energy cost reduction | Low |

| Solar installation (commercial facility) | $500,000–$2 million | 5–8 years | $100,000–$400,000 energy savings | Medium |

| Supply chain climate risk mapping | $25,000–$150,000 | Immediate risk visibility | Avoids $500,000–$5 million disruption costs | Low |

| Science-based target setting and reporting | $75,000–$300,000 | N/A (compliance/reputation) | 16% stock price premium vs. peers | Medium |

| Employee climate engagement program | $50,000–$200,000 | 12–24 months | 24% lower turnover, 3x higher satisfaction | Low |

| Procurement standard changes (emissions requirements) | $15,000–$75,000 | 6–18 months | 10–25% emissions reduction | Low |

| Renewable energy PPAs (power purchase agreements) | Minimal upfront | Immediate | Price stability, 5–15% cost reduction | Medium |

Climate risk assessment: Mapping business exposure to climate change

Treat climate as an enterprise risk that affects every operational dimension of your business.

Map your supply chain vulnerabilities. Identify which suppliers operate in climate-exposed regions. Use NOAA’s climate data tools and NASA’s risk maps to understand flood risk, drought risk, heat exposure, and sea level rise for every facility in your network.

Quantify your insurance exposure. Calculate what a 50% premium increase would do to your cost structure. Model what happens if coverage becomes unavailable for certain locations or asset types.

Assess your talent pipeline. Survey your employees about climate priorities. Understand what percentage of your workforce considers climate action when evaluating career opportunities.

Review your regulatory exposure. Identify which jurisdictions you operate in and what climate disclosure or emissions reduction requirements are coming. Build compliance into your strategic planning, not as an afterthought.

A logistics company did this assessment and discovered that 40% of their distribution centers sat in flood zones expected to see 10x more frequent flooding by 2030. They built a 10-year plan to relocate those facilities. The plan costs $50 million. Not relocating would cost $200 million in disrupted operations and insurance claims. The assessment made the decision obvious.

Climate-resilient procurement: Building sustainable supply chains

You already evaluate suppliers on cost, quality, and reliability. Add climate risk as a fourth factor.

Require suppliers to disclose their emissions and their climate risk exposure. Companies that refuse to provide data are telling you they’re not managing the risk. That’s information you need.

Prioritize suppliers with renewable energy commitments and emissions reduction targets. Studies show that companies with climate commitments have more stable operations and lower risk profiles.

Build climate resilience requirements into your contracts. Specify backup facilities. Require contingency plans. Make suppliers accountable for climate-related disruptions.

A consumer electronics company changed their procurement standards to require emissions data from all suppliers. 30% of suppliers initially refused. The company made it clear: provide data or lose the contract. Within six months, 95% complied. The data revealed which suppliers faced high climate risk. The company diversified away from the riskiest suppliers before disruptions forced emergency changes at much higher cost.

Business climate leadership: Using influence to drive industry change

You speak at industry conferences. You sit on boards. You participate in trade associations. You have peer relationships across your sector.

Use those platforms to talk about climate. Share what your company is doing. Challenge other leaders to match your commitments. Create competitive pressure that makes climate action the industry norm.

Join the CEO Climate Dialogue or We Mean Business Coalition to coordinate with other business leaders on climate advocacy. These aren’t activist organizations. They’re business leaders using their collective influence to shape policy.

Speak to your trade associations. Many trade groups actively lobby against climate policy. If you’re a member, you’re funding that opposition. Either change the association’s stance or leave and say why publicly.

A pharmaceutical CEO discovered his company’s trade association was lobbying against carbon pricing. He raised it in the association’s board meeting. When the association refused to change course, he withdrew his company’s membership and published a letter explaining why. Three other CEOs followed within a month. The association reversed its position within a year.

Energy efficiency and renewable energy: Operational climate solutions

Stop treating energy as a fixed cost. Treat it as a variable you can control through better design.

Conduct energy audits on all facilities. The EPA’s ENERGY STAR program provides free tools and technical assistance for commercial buildings and industrial facilities. Most companies find 20–30% energy savings through low-cost operational changes.

Upgrade to efficient equipment. LED lighting typically pays for itself in 18–24 months. HVAC upgrades can reduce energy consumption by 40%. Modern manufacturing equipment uses 30–50% less energy than equipment from 2010.

Switch to renewable energy where possible. Solar panels, wind power purchase agreements, and green power programs are now cost-competitive with fossil fuel energy in most markets. Bloomberg NEF reports that renewable energy is now cheapest in most of the world.

A manufacturing company in Texas installed solar panels on all warehouses and factory roofs. Initial investment: $4 million. Annual energy savings: $800,000. Payback period: five years. After payback, they save $800,000 every year while hedging against electricity price volatility.

Employee engagement in climate action: Building internal momentum

Your employees want to help. They’re waiting for leadership to make climate action a company priority and give them permission to spend time on it.

Create employee-led climate teams with real authority to propose operational changes. Don’t make this a volunteer initiative that people do in addition to their regular jobs. Give them time, budget, and executive sponsorship.

Implement employee climate challenges. Reward teams that identify emissions reductions or efficiency improvements. A professional services firm ran a six-month competition where employee teams proposed climate initiatives. The winning proposal saved the company $2 million annually in travel costs by restructuring client engagement models to reduce unnecessary trips.

Make climate part of performance reviews for managers and executives. If climate matters, it should show up in how you evaluate and compensate leadership. Set targets. Track progress. Hold people accountable.

Accenture found that companies that engage employees in sustainability initiatives see 3x higher satisfaction and 2x lower turnover.

Climate tech investment and business opportunities in sustainability

Climate action creates market opportunity.

Allocate capital to climate tech development or climate solution companies. If you’re in manufacturing, invest in low-carbon materials. If you’re in logistics, invest in electric vehicle infrastructure. If you’re in finance, fund renewable energy projects.

Global investment in climate tech reached $70 billion in 2024, and McKinsey projects a $12 trillion market opportunity in climate solutions by 2030.

Partner with research institutions on climate innovation. Universities have the expertise. Companies have the resources to scale solutions. MIT’s Climate and Sustainability Consortium connects businesses with research on carbon capture, renewable energy, and sustainable materials.

A consumer goods company invested $10 million in a startup developing biodegradable packaging alternatives. The startup succeeded. The company now has exclusive access to packaging materials that reduce plastic waste by 80%. Their competitors will pay premium prices to license the same technology in three years. The investment was climate action that created competitive advantage.

Climate reporting and emissions targets: Transparency for accountability

Publish data that stakeholders can verify and targets you’ll be held accountable for achieving.

Report your Scope 1, 2, and 3 emissions using GHG Protocol standards. Scope 3 is hard because it includes your entire supply chain, but it’s also where most emissions typically are. You can’t manage what you don’t measure.

Set science-based targets through the Science Based Targets initiative (SBTi). These aren’t arbitrary goals. They’re emissions reduction pathways aligned with limiting global warming to 1.5°C, as required by the Paris Agreement.

Publish annual progress reports showing actual performance against targets. Include successes and failures. Transparency builds credibility. Vague claims destroy it.

Companies with science-based targets outperform peers financially, likely because they manage climate risk more effectively and position themselves for regulatory changes.

Addressing the doubts: Evidence for business leaders

Some leaders still question whether climate change is urgent enough to warrant major business decisions. Others accept the science but doubt the economic case for action. Here’s what the data shows.

Temperature rise is measurable and accelerating

Global average temperature has increased 1.1°C since pre-industrial times. That doesn’t sound dramatic until you understand the impacts. 2024 was the warmest year on record, and the past decade was the warmest decade in recorded history.

NOAA reports that the rate of warming has more than doubled since 1981, accelerating from 0.07°C per decade to 0.18°C per decade. NASA data shows that 20 of the warmest years on record have occurred since 2000.

For business leaders, this translates directly to operational risk. Heat waves reduce worker productivity by 5–15% in outdoor industries. High temperatures damage data center equipment and increase cooling costs by 20–40%. Agricultural yields decline 10% for every 1°C temperature increase above optimal growing conditions.

Extreme weather and climate adaptation: Rising costs and frequency

The number of billion-dollar weather disasters in the U.S. has increased from 3 per year in the 1980s to 20+ per year in the 2020s. Global economic losses from natural disasters averaged US$270 billion annually from 2020 to 2024, up from $50 billion annually in the 1980s, adjusted for inflation.

NOAA’s attribution studies show that climate change made specific extreme weather events more likely and more severe. The 2021 Pacific Northwest heat wave was made 150x more likely by climate change. Hurricane Harvey’s rainfall was 15% more intense because of climate change, adding $10 billion to damages.

For business planning, this means the “100-year storm” now happens every 20 years. Standard deviation weather models based on historical data no longer predict future risk accurately.

Climate action ROI: Why early movers gain competitive advantage

The Stern Review on the Economics of Climate Change calculated that unmitigated climate change would cost 5–20% of global GDP annually, while taking action to limit warming would cost approximately 1% of global GDP annually.

A 2024 Nature study found that climate change is already reducing global economic growth by 0.25% per year, costing the global economy approximately $250 billion annually. By 2050, the cost could reach US$1.3 trillion per year if current trends continue.

Companies that committed to science-based emissions targets between 2015 and 2020 saw their stock prices increase 16% more than comparable companies that didn’t make commitments. Businesses with strong climate strategies have 18% lower cost of capital because investors view them as lower-risk investments.

Climate action costs less than climate inaction, and companies that move early gain competitive advantage. That much is clear.

Organizations supporting business climate action

These organizations provide tools, frameworks, and networks for business leaders taking climate action.

Business climate leadership networks

We Mean Business Coalition connects companies committed to climate action. They provide frameworks for target-setting, policy advocacy coordination, and best practice sharing. Over 400 companies representing $16 trillion in market cap participate.

Ceres mobilizes investor and business leadership on sustainability. Their CEO Climate Dialogue brings together business leaders to advocate for climate policy. They provide tools for climate risk disclosure and investor engagement.

BSR (Business for Social Responsibility) offers consulting and convening services for businesses working on sustainability. They focus on cross-sector collaboration and systems-level change.

CDP (formerly Carbon Disclosure Project) runs the global disclosure system for environmental impact. More than 23,000 companies report through CDP, providing standardized climate data to investors and stakeholders.

Science Based Targets initiative (SBTi) helps companies set emissions reduction targets aligned with climate science. They validate targets and track corporate progress. Over 9,000 companies have committed to science-based targets.

Climate science data and risk assessment tools for businesses

NOAA (National Oceanic and Atmospheric Administration) provides comprehensive climate data, monitoring, and forecasting. Their National Centers for Environmental Information offers free access to historical climate data and risk assessment tools.

NASA Climate delivers satellite data on climate change, including sea level rise, ice sheet loss, and temperature changes. Their data visualization tools make complex climate data accessible.

IPCC (Intergovernmental Panel on Climate Change) publishes comprehensive assessment reports synthesizing global climate research. Their reports represent the scientific consensus on climate change causes, impacts, and solutions.

World Resources Institute (WRI) provides data and analysis on climate impacts, emissions tracking, and climate solutions. Their Aqueduct tool helps companies assess water-related climate risks across their supply chains.

Climate policy organizations: Advocacy and implementation support

Environmental Defense Fund (EDF) works with businesses to develop market-based climate solutions. They provide technical assistance on emissions reduction and advocate for effective climate policy.

Natural Resources Defense Council (NRDC) advocates for climate policy and provides expertise on clean energy transition, transportation electrification, and industrial decarbonization.

The Nature Conservancy focuses on nature-based climate solutions. They work with businesses on forest conservation, sustainable agriculture, and ocean protection as carbon reduction strategies.

World Wildlife Fund (WWF) engages businesses on science-based targets, supply chain sustainability, and renewable energy adoption. They focus on climate solutions that also protect biodiversity.

Climate finance and sustainable investment networks

Ceres Investor Network mobilizes $72 trillion in assets under management to accelerate climate action. They provide frameworks for climate risk integration in investment decisions.

Climate Finance Leadership Initiative works with financial institutions to mobilize capital toward climate solutions. They focus on closing the climate finance gap in emerging markets.

Principles for Responsible Investment (PRI) supports investors in incorporating environmental, social, and governance factors into investment decisions. Over 5,000 institutional investors representing $120 trillion participate.

Industry climate coalitions: Sector-specific solutions and standards

RE100 unites companies committed to 100% renewable electricity. Members work together to accelerate renewable energy markets and policy support.

Corporate Electric Vehicle Alliance brings together companies electrifying their fleets. They coordinate on charging infrastructure, policy advocacy, and best practices.

First Movers Coalition commits companies to purchasing emerging climate technologies at scale, creating markets for innovations in hard-to-decarbonize sectors like steel, shipping, and aviation.

What happens when leaders choose action

You’ve read this far. You understand that climate change creates business risks you’re already experiencing: insurance costs, supply chain disruptions, talent challenges, regulatory complexity, brand reputation pressure.

The question isn’t whether climate matters to your business, because the data proves it does. The question is whether you’ll lead your company to manage that risk proactively or react to crisis after crisis as climate impacts compound.

You can assess your climate exposure this quarter. You can change procurement standards next quarter. You can engage employees on climate initiatives before year-end. You can set science-based targets and report progress transparently.

Climate action operates as operational resilience, risk management, talent retention, brand protection, and competitive positioning combined.

The leaders who act now will run companies that survive and thrive in the climate-changed economy. The leaders who wait will scramble to adapt after their competitors have already secured advantages in lower-risk supply chains, better talent, cheaper renewable energy, and stronger brands.

Lead with evidence. Lead with operational discipline. Lead because the business case is clear.

Want to discuss how your company, or you personally, can be a climate leader and help future generations?

If you’re ready to move beyond ESG theater and create actual change, let’s talk about what’s possible with your specific resources and network.

We work with leaders who want to align their influence with their values. Let’s discuss how your company can turn general concern into real action.

WorldEdits is not an NGO and it’s not involved in on-the-ground work. We’re a writing, editing, and content company that assists such organizations. We also work with corporations that want to make a difference and don’t just want to puff up their annual reports with so-called ESG accomplishments.